July 8, 2020

IMMINENT PROPERTY TAX HIKE IMPACTS PATLAK-WENDT BOARD OF REVIEW RACE

ANALYSIS & OPINION BY RUSS STEWART

“Quarantine” is a great concept. It’s sometimes used as a nautical term in which a seagoing vessel is detained in port for 40 days to contain a potential or actual infectious disease. It’s working for COVID-19. It’s not going to work to contain any real or perceived anger over the 2019/second installment property tax bills that will be due.

Isolating from your mailbox is not an option and a sizeable tax increase in the future is almost a certainty. Jefferson Township properties will be reassessed next year, but Cook County Assessor Fritz Kaegi’s “COVID-19 assessed valuation (AV) adjustments” are, according to Board of Review (BOR) candidate Tammy Wendt (D), “just smoke and mirrors.”

Home prices have been decreasing in some areas because the buyers’ market lacks capitalization. The real estate market appears to be a bit stagnant, but there is great pent-up demand that is waiting to explode, especially when courts re-open for good and another deluge of evictions and foreclosures will ensue, along with bankruptcies.

And just wait until next year. Remember these facts: Governments at all levels function and have fixed costs, which have increased significantly during the pandemic. “Pausing” the economy has collapsed commercial revenues. Chicago has a $700 million 2020 budget shortfall, and the county about a $280 million. So there will be great angst and anger over the reality that property values are declining while property taxes are increasing.

There are three solutions: One is to vote to elect Joe Biden as president and give Democrats congressional control to earmark and borrow $2-3 trillion for state and local government bailouts (aka “stimulus”), upping the national debt to $24-26 trillion. That would mean $4 of every $10 in federal tax dollars collected would go to pay debt interest. Forget about federal infrastructure improvements. The second is to APPEAL everything. Just “lawyer-up,” like the big corporations do. Or be a do-it-your-selfer, which will take some time, skill and money. Or thirdly, as they say, get out of Dodge. Take your home’s equity and bounce.

There is a political subtext to this mess, as usual. The assessor sets the AV, which for non-commercial and non-industrial property is supposedly 10 percent of the assessor’s arbitrarily determined home property value. It’s based on recent sales of the subject property, or the value in the area of “comparable” property. But here’s the catch: It’s called the “capitalization factor.”

The assessor adjusts every property index number’s AV yearly if sold, or every third year by reassessment and who knows what will happen next year. That AV is mailed to the owner of record by December-January, and the owner has 30 days to internally appeal. If not, then a Board of Review complaint containing evidence (appraisals) can be filed. According to BOR commissioner Dan Patlak (R), Wendt’s opponent, there were 174,000 complaints filed in 2013, 208,000 in 2016, and 294,000 in 2018, and slightly less in 2020. Of that number, about 200,000 were residential. Of that number, about 2 percent went to a hearing, with “lack of uniformity” as the standard of proof. That means an area residence of similar size and age is paying less taxes. The relief is to get the tax reduced to that level. The owner’s lack of income is of no consequence.

By contrast, of the 70-90,000 complaints filed on behalf of industrial/commercial properties and condos, 98 percent were handled by attorneys. The standard of proof is much different: Of consequence is profit/loss for owner corporations, vacancies for apartment/retail store owners, and assessment delinquencies for condo associations. Appraisals are handy. The BOR usually determines that the owner’s investment relative to decreased property marketability merits an AV reduction. Lawyers get a fee equal to 20 percent of the amount to be saved over the next 3 years. And, oddly, some of the grateful lawyers feel compelled to donate to the war chests of one or more of the sitting commissioners – Patlak, Mike Cabonargi (who just lost for clerk, but had over $500,000 on-hand as of Jan. 1) and Larry Rogers. The firms of Ed Burke and Mike Madigan make bundles of bucks at the Board of Review.

Once all the AVs are set and/or BOR appeals adjudicated (by June), the process goes to the Illinois Department of Revenue, which sets an “equalizer” (which was 2.91 in 2018) by which the AV is multiplied, and then to the county clerk to set a “tax rate” (which was 8.775 percent in 2018) after adding up the AV of all county parcels and the budgetary dollar demands of all local taxing units. The assessor then attaches relevant homeowner/senior exemptions, and the treasurer mails the tax bills.

One could argue that the BOR is a LAST LINE OF DEFENSE against onerous property taxes. But this is disingenuous. All the BOR does is reshuffle the AV tax burden by providing an opportunity for the smart and politically savvy to pay less than their fair share. Kaegi defeated Joe Berrios in 2018 after revelations that lower-valued property in minority areas were over-assessed, while those in upscale white areas were under-assessed. Kaegi is allegedly rectifying this situation this year, with COVID-19 breaks going to poorer neighborhoods. You get the drift. Guess who’s paying more?

Springfield Republicans created the BOR in 1996, replacing the old 2-member Board of Tax Appeals. Three districts were created: The majority-black 3rd District, the North Side/north suburban white liberal/Hispanic 2nd District, and the suburban 1st District. After remaps in 2001 and 2011, the current 1st takes in all or parts of 27 (of 30) townships, encompassing one-third of Cook County, with 1,072,993 registered suburban voters, and 62 Chicago precincts with about 60,000 RVs, including 31 precincts in the 41st Ward (Norwood Park, Oriole Park) and 27 precincts in the 19th Ward (Beverly).

The district’s minority population is less than 20 percent, with Blacks concentrated in far south Bloom, Bremen, Rich and Thornton townships and Hispanics in Berwyn and Cicero. To win in 2020, as he did in 2010, 2012 and 2016, Patlak needs just over one-half of 1st District’s one-third of the countywide vote. A Republican should be able to do that. But only if President Trump, who lost the county suburbs by 381,033 votes (699,003-317,970), Chicago by 777,626, and the county overall by 1,158,659 votes in 2016, does not do worse than that in 2020.

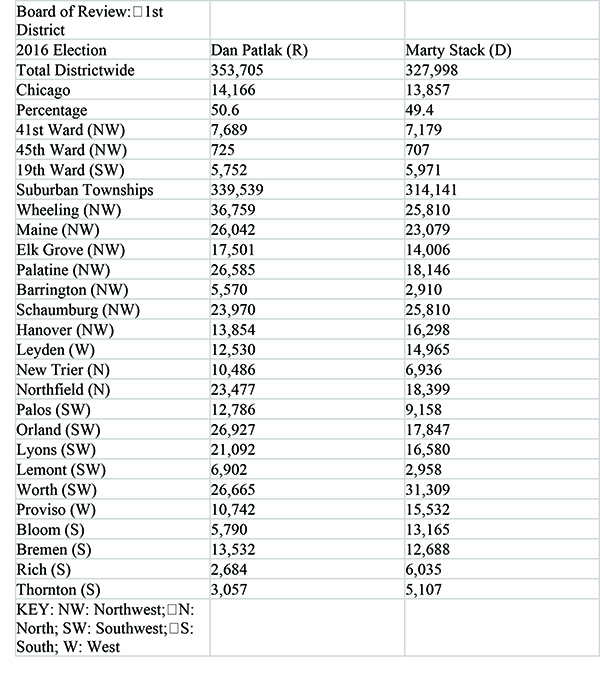

Patlak, from Wheeling, won 353,705-327,998 in 2016, a margin of 25,707 (see chart). He beat Marty Stack (D) in 14 of 27 townships, with his biggest margins in the northwest (Wheeling, Palatine, Elk Grove and Maine) and southwest (Orland, Palos, Lyons and Lemont) townships, plus New Trier. Any 2020 erosion would be fatal. Trump is an anchor, but Patlak has two advantages: He had $598,153 on-hand as of March 31, and Wendt was third chair for the Jason Van Dyke defense team in the Laquan McDonald murder trial. Patlak must be careful how he uses this, if at all.

Wendt won the March 17 primary 110,559-91893 over the slated Abdelnasser Rashid, carrying 20 of 27 townships and all three wards. Rashid spent $202,800 to Wendt’s $18,420. Wendt is well-positioned to win on Nov. 3.

Patlak has $600,000 and he can use that to define and demonize Wendt or to portray himself as the tax-stopper. Whatever his strategy is time is wasting.